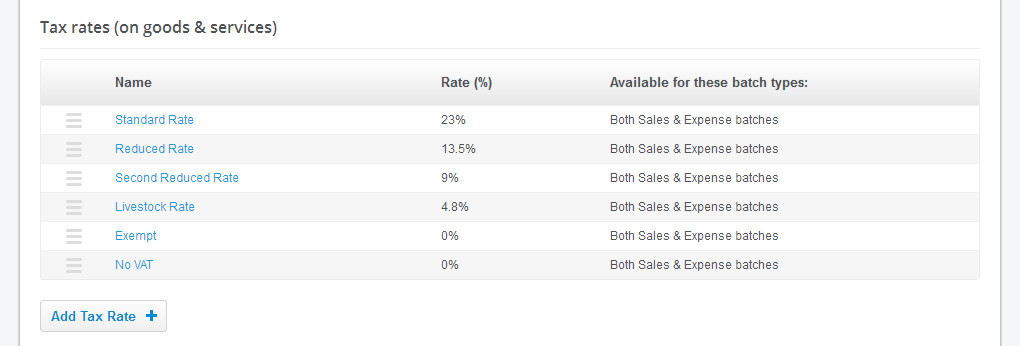

You can reorder the tax rate types by using the move & drag button on the left of any row. This will change the order of how they appear within batch entry dropdowns and the tax reports

Click on a rate name to edit the rate settings

The name you enter must be unique

The unique name may be used for import purposes when importing a sales/expense batch (see detail on the import page itself to learn more). In short, this is mainly useful if there are two or more tax rates that use the same % value. Otherwise we would suggest it is easiest to just enter the % value in the import template itself for your own clarity

'Available for these batch types' is an option where users want to completely separate tax rates between sales and expenses (it may depend on your country/region as to what's best)